Bankruptcy law and proceedings offer a lifeline for individuals and businesses facing overwhelming debt. This complex legal framework provides a structured process for managing financial distress, allowing debtors to restructure their obligations or discharge their debts entirely. From understanding the different types of bankruptcy to navigating the filing process and the rights of both debtors and creditors, navigating the world of bankruptcy requires a clear understanding of the legal landscape.

This guide explores the intricacies of bankruptcy law, shedding light on the various chapters of the Bankruptcy Code, the key stages of the bankruptcy process, and the ethical considerations involved. We delve into the rights and obligations of debtors, the remedies available to creditors, and the potential consequences of both compliance and non-compliance with bankruptcy regulations.

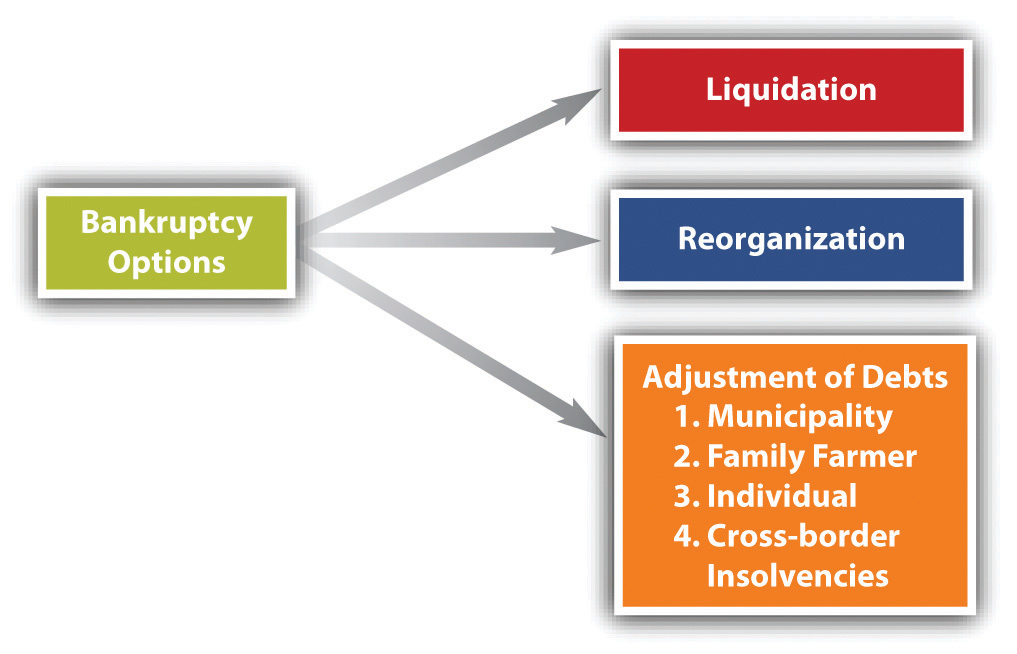

Types of Bankruptcy Proceedings: Bankruptcy Law And Proceedings

The United States Bankruptcy Code provides several different chapters that Artikel the procedures and outcomes for individuals and businesses facing financial distress. Understanding the different chapters is crucial for debtors and creditors alike, as each chapter offers unique options and consequences.

Also Read

Chapter 7: Liquidation

Chapter 7 is the most common type of bankruptcy, often referred to as “straight bankruptcy.” It involves the liquidation of a debtor’s assets to pay off creditors.

- Eligibility: Individuals, businesses, and non-profit organizations are eligible for Chapter 7 bankruptcy. However, there are specific income and asset limitations. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) introduced the “means test” to determine eligibility for Chapter 7. The means test calculates a debtor’s disposable income, which is the income remaining after deducting essential living expenses. If the debtor’s disposable income is above a certain threshold, they may not be eligible for Chapter 7.

- Process: In a Chapter 7 case, the debtor files a petition with the bankruptcy court, listing their assets and liabilities. The court then appoints a trustee to administer the case. The trustee gathers the debtor’s assets, sells them, and distributes the proceeds to creditors according to the priority established by the Bankruptcy Code.

- Outcomes: Upon successful completion of the Chapter 7 process, the debtor receives a discharge from most of their debts. This means they are no longer legally obligated to repay those debts. However, some debts are non-dischargeable, such as student loans, alimony, child support, and certain taxes.

Chapter 11: Reorganization

Chapter 11 bankruptcy is designed for businesses, individuals with substantial debt, and non-profit organizations seeking to restructure their debts and continue operating.

- Eligibility: Chapter 11 is available to businesses, individuals, and non-profit organizations, regardless of their size or financial situation. However, the process is more complex and expensive than Chapter 7.

- Process: In a Chapter 11 case, the debtor files a plan of reorganization with the court, outlining how they will restructure their debts and continue operating. The plan must be approved by the court and a majority of the creditors. The debtor continues to operate their business under the supervision of the court and a trustee.

- Outcomes: A successful Chapter 11 reorganization allows the debtor to continue operating their business, often with a reduced debt load. The plan may include modifications to loan terms, interest rates, or repayment schedules. However, some creditors may not be fully repaid, and the debtor may be required to make certain concessions, such as selling assets or restructuring their operations.

Chapter 13: Adjustment of Debts for Individuals with Regular Income

Chapter 13 bankruptcy is designed for individuals with regular income who want to repay their debts over a three to five-year period.

- Eligibility: Chapter 13 is only available to individuals with regular income who meet certain debt and income limitations. It is not available to businesses or non-profit organizations.

- Process: In a Chapter 13 case, the debtor files a plan with the court outlining how they will repay their debts over a three to five-year period. The plan must be approved by the court and creditors. The debtor makes monthly payments to a trustee, who then distributes the funds to creditors.

- Outcomes: A successful Chapter 13 plan allows the debtor to keep their assets and avoid liquidation. Once the plan is completed, the debtor receives a discharge from most of their debts.

Filing for Bankruptcy

Filing for bankruptcy is a complex legal process that requires careful consideration and planning. It involves seeking protection from creditors by filing a petition with the bankruptcy court. The process aims to reorganize a debtor’s finances, discharge debts, and provide a fresh start.

Steps Involved in Filing a Bankruptcy Petition

The process of filing for bankruptcy involves several key steps:

- Consult with an attorney: Seeking advice from a qualified bankruptcy attorney is crucial before filing. They can help determine the best course of action, gather necessary documents, and guide you through the process.

- Gather financial information: You will need to compile detailed financial information, including income, expenses, assets, and liabilities. This information will be used to prepare the bankruptcy petition.

- Complete and file the bankruptcy petition: The bankruptcy petition is a legal document that Artikels your financial situation and requests the court’s protection. It must be filed with the appropriate bankruptcy court.

- Attend a creditors’ meeting: After filing, a meeting with your creditors will be scheduled. This meeting allows creditors to ask questions and receive information about the bankruptcy case.

- Complete the bankruptcy process: Depending on the type of bankruptcy filed, the process may involve developing a repayment plan, selling assets, or receiving a discharge of debts.

Essential Documents for Filing

A comprehensive checklist of essential documents is required for filing a bankruptcy petition:

- Proof of income: Pay stubs, tax returns, and other documentation demonstrating your income.

- Proof of expenses: Bills, receipts, and other records reflecting your monthly expenses.

- Asset list: A detailed list of all your assets, including their value and ownership.

- Debt list: A comprehensive list of all your debts, including the amount owed, creditor name, and account numbers.

- Tax returns: Copies of your most recent tax returns.

- Bank statements: Recent bank statements for all accounts.

- Credit card statements: Recent statements for all credit cards.

- Mortgage documents: If applicable, documentation related to your mortgage.

- Other relevant documents: Any other documents that may be relevant to your financial situation, such as divorce decrees, medical bills, or court orders.

Role of the Bankruptcy Court and the U.S. Trustee, Bankruptcy law and proceedings

The bankruptcy court plays a crucial role in overseeing the bankruptcy process. The court will review the petition, schedule hearings, and make decisions about the case. The U.S. Trustee is a federal official responsible for overseeing bankruptcy cases and ensuring that debtors comply with the law. They have the authority to investigate fraudulent activity, monitor the trustee’s performance, and ensure that creditors are treated fairly.

The U.S. Trustee is appointed by the Attorney General and serves as an independent watchdog in the bankruptcy system.

The Bankruptcy Process

Once a bankruptcy petition is filed, the legal journey begins. The bankruptcy process is a structured and regulated procedure designed to manage the financial affairs of the debtor and ensure a fair and equitable outcome for both the debtor and their creditors. This process involves various stages, each with specific objectives and procedures.

Automatic Stay

The automatic stay is a crucial aspect of bankruptcy proceedings. It acts as a legal shield, protecting the debtor from most creditor actions immediately upon the filing of the bankruptcy petition. This stay prohibits creditors from taking any actions to collect debts, including:

- Filing lawsuits

- Foreclosing on property

- Garnishing wages

- Repossessing property

The automatic stay provides the debtor with a breathing space to reorganize their finances and negotiate with creditors without facing immediate pressure or legal action. However, it’s important to note that the automatic stay does not apply to all types of creditor actions, such as domestic support obligations or criminal proceedings.

Creditor Notification and Claims Filing

After the bankruptcy petition is filed, the court will notify all creditors about the case. Creditors are required to file a proof of claim, a formal document outlining the amount of debt owed to them by the debtor. This process ensures that all creditors have a chance to participate in the bankruptcy proceedings and receive their fair share of the debtor’s assets.

- The court will issue a notice of bankruptcy case to all known creditors, informing them of the filing and the deadline for filing a proof of claim.

- Creditors have a specific timeframe to file their claims, typically within a few months after the notice is issued.

- The proof of claim must include detailed information about the debt, such as the amount owed, the date the debt was incurred, and any supporting documentation.

- Creditors who fail to file a proof of claim within the designated timeframe may lose their right to participate in the bankruptcy proceedings and receive payment.

The Bankruptcy Trustee

A bankruptcy trustee is appointed by the court to oversee the administration of the bankruptcy case. The trustee is responsible for:

- Gathering and liquidating the debtor’s assets

- Investigating the debtor’s financial affairs

- Distributing the proceeds from the sale of assets to creditors in accordance with the bankruptcy code

- Monitoring the debtor’s compliance with the bankruptcy plan

The trustee acts as an impartial party, ensuring that the bankruptcy process is conducted fairly and transparently. They have the power to challenge fraudulent claims and pursue recovery of assets that were improperly transferred by the debtor. The trustee plays a crucial role in ensuring that the bankruptcy process benefits both the debtor and their creditors.

Navigating bankruptcy can be a daunting experience, but understanding the legal framework empowers individuals and businesses to make informed decisions. Whether seeking relief from personal debt or restructuring a struggling business, knowledge is power. This guide serves as a starting point for navigating the complexities of bankruptcy law, providing a comprehensive overview of the process, the rights and responsibilities involved, and the potential outcomes. By understanding the principles and procedures of bankruptcy, individuals and businesses can make informed decisions that best serve their financial well-being.