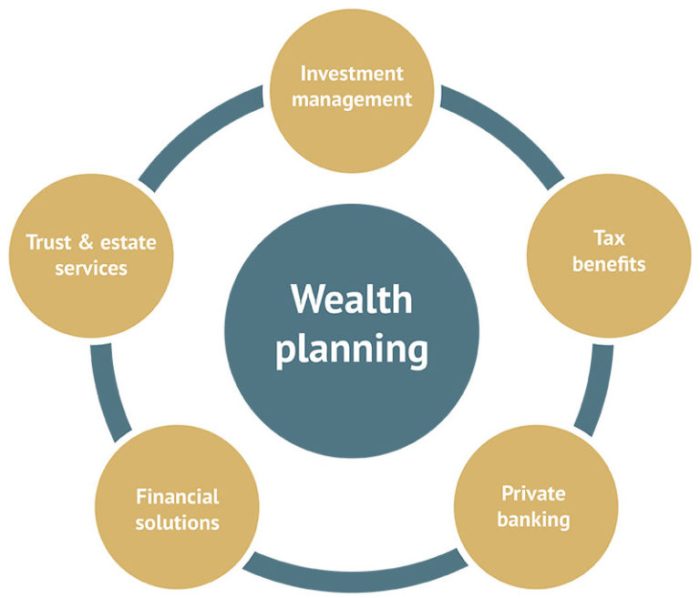

Wealth transfer planning sets the stage for a smooth transition of assets, ensuring your hard-earned wealth aligns with your wishes and goals. It’s a comprehensive strategy that encompasses estate planning, tax optimization, and asset protection, ensuring your legacy is preserved and passed on effectively.

From crafting a will to establishing trusts and minimizing tax liabilities, wealth transfer planning involves a multifaceted approach. It’s not just about passing on financial assets but also about safeguarding your family’s future and ensuring your values are reflected in the distribution of your wealth.

Understanding Wealth Transfer Planning

Wealth transfer planning involves strategizing how to distribute your assets to your chosen beneficiaries after your death. It’s an essential part of estate planning, ensuring your wealth is transferred according to your wishes and minimizing potential tax liabilities.

Also Read

Wealth transfer planning often involves complex considerations, particularly when dealing with individuals who may be facing health challenges. Understanding the intricacies of Social Security disability law is crucial for ensuring the well-being of beneficiaries, as it can impact the timing and amount of asset transfers to minimize tax implications and potential estate planning challenges.

Importance of Wealth Transfer Planning

Wealth transfer planning is crucial for several reasons:

- Minimizing Taxes: Proper planning can help reduce estate taxes, which can be significant, especially for larger estates. Strategies like gifting assets or establishing trusts can help mitigate tax burdens.

- Protecting Your Assets: Planning ensures your assets are distributed according to your wishes, preventing potential disputes among heirs or unintended consequences.

- Providing for Loved Ones: It allows you to provide financial security for your loved ones, ensuring they are taken care of after your passing.

- Preserving Family Legacy: By establishing a plan, you can help preserve your family’s wealth and values for future generations.

Key Goals and Objectives, Wealth transfer planning

Wealth transfer planning aims to achieve specific goals, including:

- Distribution of Assets: Determining how your assets will be divided among your beneficiaries.

- Minimizing Estate Taxes: Employing strategies to reduce the tax burden on your estate.

- Protecting Assets from Creditors: Ensuring your assets are shielded from potential claims by creditors.

- Providing for Special Needs: Creating provisions for beneficiaries with special needs, ensuring their financial security.

- Maintaining Control: Retaining some control over your assets even after your death, such as through trusts.

Wealth Transfer Strategies

Various strategies can be used to achieve wealth transfer goals, including:

- Wills and Trusts: These legal documents Artikel how your assets will be distributed after your death. A will directs the distribution of your estate, while a trust can hold and manage assets for beneficiaries.

- Gifting: Making gifts to beneficiaries during your lifetime can reduce your estate’s value and potentially lower estate taxes.

- Life Insurance: Life insurance proceeds can provide financial support to beneficiaries after your death, helping to replace lost income or cover expenses.

- Retirement Accounts: Retirement accounts like IRAs and 401(k)s can be passed on to beneficiaries, offering tax-advantaged income streams.

- Charitable Giving: Making charitable donations can reduce your taxable estate and provide tax benefits.

Tax Implications of Wealth Transfer

Wealth transfer planning involves carefully considering the tax implications of transferring assets during your lifetime or at death. Understanding these tax implications is crucial for maximizing the value of your assets and ensuring that your beneficiaries receive the intended inheritance.

Gift Taxes

Gift taxes are levied on the transfer of assets during a person’s lifetime. The annual exclusion, currently $17,000 per recipient in 2023, allows individuals to make gifts to as many recipients as they choose without incurring gift tax liability. Gifts exceeding the annual exclusion are subject to gift tax rates, which are progressive, meaning they increase as the value of the gift increases.

Wealth transfer planning often involves intricate strategies to ensure assets are distributed effectively. One element that can factor into this process is the use of reverse mortgages, which can provide access to home equity for seniors. For those considering this option, seeking reverse mortgage counseling can help navigate the complexities and determine if it aligns with their overall financial goals.

Estate Taxes

Estate taxes are levied on the value of assets transferred at death. The federal estate tax exemption is currently $12.92 million per person in 2023. This means that estates valued at $12.92 million or less are not subject to federal estate tax. However, estates exceeding this exemption are subject to estate tax rates, which are also progressive.

Wealth transfer planning involves careful consideration of various factors, including potential long-term care needs. As individuals age, the risk of requiring nursing home care increases, making it crucial to understand the legal implications of such care. If you suspect abuse or neglect in a nursing home, seeking legal counsel is essential. Nursing home abuse law protects the rights of residents and holds facilities accountable for their actions.

By understanding the legal landscape, families can better protect their loved ones and ensure their financial well-being during this vulnerable period.

Impact of Gift and Estate Taxes on Wealth Transfer Strategies

Gift and estate taxes can significantly impact wealth transfer strategies. For example, if a person wants to transfer a large amount of wealth to their children, they may consider making gifts during their lifetime to take advantage of the annual exclusion and reduce their taxable estate. However, they should also consider the potential impact of gift taxes on their future financial planning.

Wealth transfer planning involves ensuring your assets are distributed according to your wishes, but it’s crucial to consider the potential need for legal guardianship, especially as you age. A well-structured plan should address potential health issues and consider establishing a legal guardian, like a trusted family member, to make decisions for you in the event of incapacitation. For more information on navigating the complexities of legal guardianship for the elderly, visit Legal guardianship for elderly.

This ensures your wishes are respected and your financial future is secure.

Tax-Efficient Wealth Transfer Techniques

Several techniques can be used to minimize the tax implications of wealth transfer. Some common strategies include:

- Gifting within the annual exclusion: As mentioned earlier, individuals can gift up to $17,000 per recipient per year without incurring gift tax liability. This is a simple and effective way to reduce the size of your taxable estate.

- Utilizing the lifetime gift tax exemption: The lifetime gift tax exemption, currently $12.92 million per person in 2023, allows individuals to make gifts exceeding the annual exclusion without incurring gift tax liability. This can be a valuable tool for transferring large amounts of wealth to heirs during your lifetime.

- Establishing a trust: Trusts can be used to transfer assets to beneficiaries while maintaining control over those assets during your lifetime. Trusts can also help to reduce estate taxes by minimizing the size of your taxable estate.

- Utilizing charitable giving: Charitable donations can be a tax-efficient way to transfer wealth. Donating appreciated assets to charity can avoid capital gains tax and provide a charitable deduction.

- Proper asset allocation: Careful asset allocation can help to reduce the tax implications of wealth transfer. For example, investing in assets that are not subject to capital gains tax, such as municipal bonds, can help to minimize the tax burden on your estate.

Strategies for Wealth Transfer

Wealth transfer planning involves strategically transferring assets to beneficiaries during your lifetime or upon your death. This process aims to minimize tax liabilities and ensure your assets are distributed according to your wishes. Understanding the available strategies and their implications is crucial to achieving your wealth transfer goals.

Wealth transfer planning is a complex process, especially when it involves aging loved ones. It’s crucial to ensure their wishes are respected and their assets are managed effectively. A key component of this planning is establishing a Power of attorney for elderly which grants a trusted individual the authority to make financial and healthcare decisions on their behalf should they become incapacitated.

This document can help streamline the transfer of wealth while safeguarding the interests of the individual throughout their later years.

Wealth Transfer Strategies

Various strategies can be employed to transfer wealth, each with its own advantages and disadvantages. Here is a comparison of some common approaches:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Direct Gifts |

|

|

| Trusts |

|

|

| Life Insurance |

|

|

| Charitable Giving |

|

|

Sample Wealth Transfer Plan

Imagine a successful entrepreneur, Sarah, aged 60, with a net worth of $10 million. She wants to ensure her wealth is distributed to her children and grandchildren while minimizing tax implications. A potential wealth transfer plan for Sarah might involve:

- Direct Gifts: Sarah could utilize the annual gift tax exclusion to make annual gifts to her children and grandchildren. This would allow her to transfer a significant portion of her wealth over time without incurring gift tax liability.

- Trusts: Sarah could establish a trust to hold a portion of her assets. This would provide asset protection and potentially reduce estate tax liability. She could designate her children as beneficiaries and set up a distribution schedule for her grandchildren.

- Life Insurance: Sarah could purchase a life insurance policy with a death benefit that would provide her beneficiaries with a lump sum upon her death. This could be used to offset estate tax liability or provide additional financial support to her family.

- Charitable Giving: Sarah could make charitable donations to organizations she supports, which would provide tax deductions and potentially reduce her estate tax liability.

Protecting Your Assets

In the realm of wealth transfer planning, safeguarding your assets from unforeseen circumstances is paramount. Asset protection planning ensures that your wealth is shielded from potential threats, allowing your intended beneficiaries to receive the full benefit of your legacy.

Common Threats to Wealth

Protecting your assets from various threats is crucial to ensure your wealth transfer plan is successful. Common threats to wealth include lawsuits, creditors, and divorce.

- Lawsuits: A lawsuit, regardless of its merit, can drain your financial resources through legal fees and potential settlements.

- Creditors: In the event of financial difficulties, creditors can pursue your assets to recover their debts, potentially jeopardizing your wealth transfer plan.

- Divorce: Marital dissolution can significantly impact your assets, as they become subject to division in accordance with state laws.

Strategies for Minimizing Asset Vulnerability

Effective asset protection planning involves implementing strategies that minimize the vulnerability of your assets to these threats.

Wealth transfer planning is an essential component of a comprehensive financial strategy, ensuring your assets are distributed according to your wishes. While many focus on estate planning, understanding the process of Probate administration for seniors is crucial. This process, which involves the legal administration of an estate after death, can be complex and time-consuming. By understanding the potential complexities of probate, you can better prepare for the future and ensure your legacy is handled smoothly.

- Establish a Trust: A trust is a legal entity that holds assets for the benefit of designated beneficiaries. It can provide protection against lawsuits and creditors, as the assets held within the trust are typically not subject to direct claims.

- Utilize Limited Liability Entities: Operating a business through a limited liability entity, such as an LLC or corporation, can shield your personal assets from business liabilities.

- Asset Titling Strategies: The way you title your assets can significantly impact their vulnerability to claims. For instance, holding assets jointly with another individual can expose them to potential liability in the event of that individual’s financial difficulties.

- Insurance Coverage: Adequate insurance coverage, such as liability insurance and umbrella insurance, can provide a financial safety net in the event of unforeseen events.

- Premarital Agreements: In the context of marriage, a premarital agreement can define the division of assets in the event of divorce, protecting your wealth from potential claims.

Ethical Considerations

Wealth transfer planning is not just about numbers and strategies; it’s also about navigating complex ethical considerations. While ensuring your financial legacy is important, it’s equally crucial to do so in a way that aligns with your values and respects the relationships involved.

Transparency and Communication

Open and honest communication with beneficiaries is essential for ethical wealth transfer planning. This transparency fosters trust and understanding, preventing misunderstandings and potential conflicts.

- Clear and concise communication: Clearly communicate your intentions and the rationale behind your wealth transfer decisions. This can involve outlining specific goals, such as supporting education or charitable causes, and explaining how your chosen strategies align with these objectives.

- Open discussions: Encourage open discussions with beneficiaries about their needs and aspirations. This allows you to tailor your wealth transfer plan to their individual circumstances and ensure the plan aligns with their long-term goals.

- Addressing concerns: Actively address any concerns or questions beneficiaries may have. This demonstrates your commitment to fairness and ensures everyone feels heard and respected.

Fairness and Equity

Fairness and equity are central to ethical wealth transfer planning. This means considering the needs and circumstances of all beneficiaries, striving for a distribution that reflects their individual situations and avoids favoritism.

- Equal treatment: While equal distribution might seem like the most straightforward approach, it might not be the fairest. Consider each beneficiary’s financial situation, age, and needs when making decisions.

- Individualized plans: Developing individualized plans for each beneficiary can address specific needs and circumstances. This could involve providing financial support for education, starting a business, or covering healthcare expenses.

- Avoiding favoritism: It’s essential to avoid favoring one beneficiary over another. This can create resentment and damage family relationships. Transparency and open communication can help address potential concerns about favoritism.

Potential Conflicts of Interest

Conflicts of interest can arise when individuals involved in wealth transfer planning have competing interests or incentives. These conflicts can lead to unfair or unethical decisions.

- Example: A financial advisor who recommends investments that benefit their own firm over the best interests of the client.

- Addressing conflicts: To address potential conflicts, ensure transparency and disclosure of any potential conflicts of interest. Consider seeking independent advice from a trusted professional who does not have a vested interest in the decisions being made.

Seeking Professional Guidance: Wealth Transfer Planning

Navigating the complex world of wealth transfer planning can be daunting, even for those with significant financial resources. This is where seeking professional guidance from qualified experts becomes crucial. Engaging with experienced professionals can provide invaluable insights, ensuring your wealth transfer plan aligns with your goals, minimizes potential tax liabilities, and protects your legacy.

Benefits of Professional Guidance

Seeking professional guidance from estate planning attorneys and financial advisors offers numerous benefits, ensuring your wealth transfer plan is comprehensive, efficient, and tailored to your specific needs.

- Expert Knowledge and Experience: Estate planning attorneys and financial advisors possess specialized knowledge and experience in navigating the intricacies of wealth transfer laws, tax regulations, and investment strategies. They can provide informed advice, helping you make informed decisions about your wealth transfer plan.

- Personalized Strategies: Professionals tailor wealth transfer strategies to your unique circumstances, goals, and risk tolerance. This personalized approach ensures your plan effectively addresses your specific needs and objectives, maximizing the benefits for your beneficiaries.

- Minimizing Tax Liabilities: Wealth transfer planning involves navigating complex tax laws and regulations. Professionals can identify and implement strategies to minimize tax liabilities, ensuring your beneficiaries receive the maximum possible inheritance.

- Protecting Your Assets: Estate planning attorneys can help you structure your assets and establish trusts to protect your wealth from potential legal challenges, creditor claims, and other unforeseen circumstances.

- Peace of Mind: Having a comprehensive wealth transfer plan in place provides peace of mind, knowing your assets are protected, your wishes are honored, and your beneficiaries are taken care of.

Key Questions to Ask Potential Advisors

When selecting an estate planning attorney or financial advisor, it is crucial to conduct thorough due diligence and ask the right questions. This ensures you choose professionals who understand your needs and possess the expertise to guide you effectively.

- Experience and Expertise: Inquire about the advisor’s experience in wealth transfer planning, specifically focusing on your unique situation and the type of assets you wish to transfer.

- Professional Credentials and Licenses: Verify the advisor’s professional credentials, licenses, and certifications, ensuring they are qualified to provide financial and legal advice.

- Fees and Payment Structure: Discuss the advisor’s fees and payment structure upfront to avoid any surprises and ensure transparency.

- Communication Style and Approach: Evaluate the advisor’s communication style and approach, ensuring they are responsive, clear, and willing to explain complex concepts in an understandable manner.

- References and Testimonials: Request references from previous clients to gain insights into the advisor’s experience, professionalism, and client satisfaction.

Comprehensive Estate Plan Review

A comprehensive review of your estate plan is essential, even if you have already established one. This review ensures your plan remains aligned with your current goals, circumstances, and legal requirements.

- Changes in Life Circumstances: Life events such as marriage, divorce, birth, death, or significant changes in your financial situation can necessitate revisions to your estate plan.

- Changes in Tax Laws and Regulations: Tax laws and regulations are constantly evolving, potentially impacting your wealth transfer plan. Regular reviews ensure your plan remains compliant and minimizes tax liabilities.

- Reviewing Beneficiary Designations: Ensure your beneficiary designations for accounts, trusts, and insurance policies are up-to-date and reflect your current wishes.

- Updating Estate Planning Documents: Review and update your estate planning documents, such as wills, trusts, powers of attorney, and healthcare directives, to reflect any changes in your circumstances or goals.

By proactively engaging in wealth transfer planning, you can gain peace of mind knowing your assets will be distributed according to your wishes, minimizing potential conflicts and ensuring a seamless transition for your loved ones. It’s a process that requires careful consideration, professional guidance, and a commitment to safeguarding your legacy for generations to come.