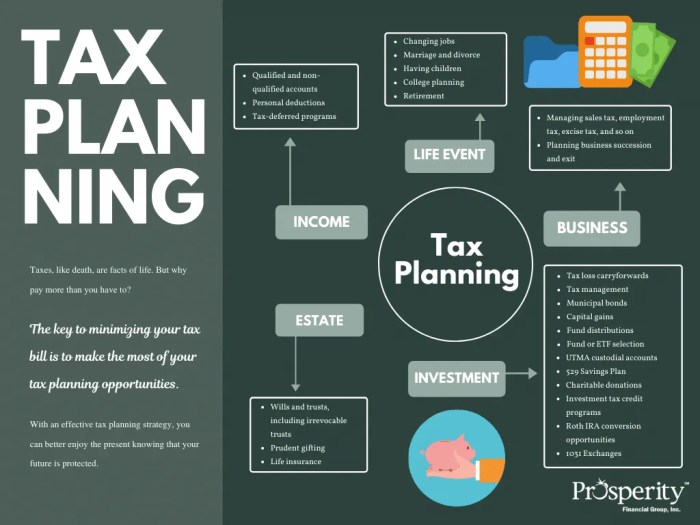

Estate tax planning strategies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The intricacies of estate tax planning can be daunting, but navigating this complex landscape is crucial for ensuring your wealth and legacy are preserved for generations to come.

This comprehensive guide will demystify the process, equipping you with the knowledge and tools to make informed decisions about your financial future. From understanding the basics of estate tax to exploring advanced strategies like gifting, trusts, and charitable giving, we will delve into the intricacies of estate planning, highlighting key considerations and potential pitfalls along the way.

Understanding Estate Tax

Estate tax is a federal tax levied on the fair market value of a deceased person’s assets, known as their estate, exceeding a certain exemption threshold. It’s designed to ensure that the wealthy contribute their fair share to society even after death.

Also Read

Estate Tax Exemption

The estate tax exemption is the amount of assets that can be passed down to heirs without incurring any estate tax. The exemption is adjusted annually for inflation. In 2023, the exemption is $12.92 million per person, meaning a married couple can pass down up to $25.84 million without facing estate tax. This generous exemption means that only a small percentage of estates are actually subject to the tax.

The estate tax exemption is subject to change by Congress. In the past, the exemption has been reduced, and it could be reduced again in the future.

Common Assets Subject to Estate Tax

A wide range of assets can be subject to estate tax, including:

- Real estate

- Stocks and bonds

- Cash

- Life insurance proceeds

- Retirement accounts

- Businesses

- Art and collectibles

Gifting Strategies

Gifting can be a powerful tool for reducing estate tax liability. By strategically transferring assets to beneficiaries during your lifetime, you can lower the value of your estate subject to estate tax. This strategy allows you to take advantage of the annual gift tax exclusion and potentially minimize the tax burden on your heirs.

Annual Gift Tax Exclusion

The annual gift tax exclusion allows individuals to gift a certain amount of money or property to others each year without incurring any gift tax liability. The exclusion amount for 2023 is $17,000 per recipient. This means you can gift up to $17,000 to each of your children, grandchildren, or other individuals without having to file a gift tax return.

The annual gift tax exclusion is adjusted annually for inflation.

Types of Gifts

There are different types of gifts that can be made, each with its own tax implications.

Outright Gifts

An outright gift is a transfer of property to a recipient with no strings attached. The recipient immediately becomes the owner of the property and is responsible for any taxes or other obligations associated with it.

Gifts in Trust

A gift in trust involves transferring property to a trustee, who manages the assets for the benefit of the beneficiaries. This allows you to maintain some control over the assets while minimizing estate tax liability.

Gifts of Life Insurance

Gifting a life insurance policy can be a valuable strategy for estate tax planning. The death benefit from a life insurance policy is generally not included in the deceased’s estate for tax purposes.

Estate tax planning strategies often involve minimizing the tax burden on inherited assets. This can include strategies like gifting assets to beneficiaries, setting up trusts, or utilizing charitable giving. A key aspect of such planning is ensuring the well-being of beneficiaries, particularly if they are elderly or have special needs. In such cases, it may be prudent to consider establishing legal guardianship, as outlined on the Legal guardianship for elderly website, to ensure their financial and personal needs are met.

By addressing these issues early, estate planners can create a legacy that protects both the financial interests and the well-being of loved ones.

Gifts of Real Estate

Real estate can be a valuable asset for estate tax planning. You can gift real estate to your heirs, but it’s important to consider the potential capital gains tax implications.

Estate tax planning strategies are crucial for individuals looking to minimize their tax burden and ensure a smooth transition of assets to their heirs. A key element in this process is understanding the complexities of probate administration, which can be particularly challenging for seniors. For those navigating the intricacies of probate, resources like Probate administration for seniors can provide valuable guidance and support.

By understanding the nuances of probate and implementing effective estate planning strategies, individuals can protect their assets and ensure their legacy is preserved for future generations.

Gifts of Stocks and Bonds

Gifting stocks and bonds can be a good way to transfer wealth to heirs while minimizing estate tax liability. The recipient of the gift will inherit the cost basis of the securities, which can help to reduce capital gains tax liability.

Important Considerations

When making gifts, it’s essential to consider the following factors:

- The value of the gift

- The recipient’s tax bracket

- The potential impact on the donor’s estate tax liability

- The potential gift tax implications

It’s also important to consult with a qualified tax advisor to develop a gifting strategy that meets your individual needs and goals.

Trusts and Estate Planning: Estate Tax Planning Strategies

Trusts are powerful tools that can be used to achieve a variety of estate planning goals, including minimizing estate taxes, protecting assets from creditors, and ensuring that assets are distributed according to your wishes. A trust is a legal arrangement where a trustee holds assets for the benefit of beneficiaries.

Types of Trusts

The choice of trust depends on the specific goals and circumstances of the individual. Here are some common types of trusts:

- Revocable Living Trust: This type of trust is created while the grantor is alive and can be modified or revoked at any time. It allows the grantor to retain control over the assets during their lifetime.

- Irrevocable Living Trust: This type of trust is created while the grantor is alive, but it cannot be modified or revoked after its creation. This trust offers significant tax advantages and asset protection, but the grantor loses control over the assets.

- Testamentary Trust: This type of trust is created in a will and takes effect after the grantor’s death. It allows the grantor to control how their assets are distributed to beneficiaries.

- Special Needs Trust: This type of trust is designed to protect the assets of individuals with disabilities who receive government benefits. It allows the trustee to manage the assets without jeopardizing the beneficiary’s eligibility for government assistance.

Designing a Sample Trust Structure

Imagine a hypothetical estate where a wealthy individual wants to minimize estate taxes and ensure that their assets are distributed to their children and grandchildren. This individual could establish a revocable living trust to hold their assets during their lifetime and a testamentary trust to distribute the assets after their death. The revocable living trust would allow the individual to retain control over the assets during their lifetime and make changes to the trust as needed.

The testamentary trust would be created in the individual’s will and would distribute the assets to the individual’s children and grandchildren in a tax-efficient manner. The testamentary trust could be structured to provide for the individual’s children and grandchildren in a way that meets their specific needs. For example, the trust could provide for the children to receive a portion of the assets upon reaching a certain age or to receive income from the trust for a specified period.

This is just a simple example, and the specific details of a trust structure should be tailored to the individual’s unique circumstances and goals.

Estate tax planning strategies often involve minimizing the taxable estate, and one important aspect is ensuring that assets are managed effectively. This is where a Power of attorney for elderly can play a crucial role. By appointing a trusted individual to handle financial and legal matters, families can safeguard their loved ones’ interests and minimize potential tax burdens.

Life Insurance and Estate Planning

Life insurance can play a crucial role in estate planning by providing financial security for beneficiaries and mitigating potential estate tax liabilities. It can also be used to cover expenses associated with death, such as funeral costs and outstanding debts.

Taxation of Life Insurance Proceeds

Life insurance proceeds received by beneficiaries are generally not subject to federal income tax. However, there are exceptions to this rule. For example, if the policy was transferred for valuable consideration or if the proceeds are used in a business, they may be subject to income tax.

Estate tax planning strategies often involve minimizing the value of an estate to reduce tax liability. This can include gifting assets to beneficiaries, setting up trusts, or establishing charitable giving programs. However, it’s crucial to consider the potential impact of unforeseen circumstances, such as the need for long-term care. If a loved one requires nursing home care, understanding the complexities of nursing home abuse law is essential to protect both their rights and your financial interests.

Estate planning should encompass a comprehensive view of potential risks and vulnerabilities, ensuring that assets are protected and beneficiaries are adequately cared for.

- Death benefit proceeds: The death benefit received by a named beneficiary is generally tax-free. This means that the beneficiary does not have to pay income tax on the amount received.

- Policy cash value: The cash value of a life insurance policy can be withdrawn by the policyholder during their lifetime. These withdrawals are generally considered taxable income.

- Policy loans: Taking out a loan against the cash value of a life insurance policy is not considered taxable income. However, interest accrued on the loan may be taxable.

Using Life Insurance to Cover Estate Tax Liabilities

Life insurance can be a valuable tool for covering estate tax liabilities. When a person dies, their estate is subject to estate tax if the value of the estate exceeds the applicable exclusion amount.

Estate tax planning strategies can be complex, involving careful consideration of assets, beneficiaries, and potential tax liabilities. A key component of this planning often involves establishing wills and trusts, which can help minimize estate taxes and ensure assets are distributed according to your wishes. To navigate this process, consulting with a qualified Will and trust attorney is crucial.

They can provide personalized guidance, draft legal documents, and help you develop a comprehensive estate plan that aligns with your goals and financial situation.

- Irrevocable Life Insurance Trust (ILIT): An ILIT is a trust that holds a life insurance policy. The policy’s death benefit is paid to the trust, which then distributes the proceeds to the beneficiaries according to the trust’s terms. Because the policy is owned by the trust, it is not included in the insured’s estate for estate tax purposes. This strategy can help reduce the amount of estate tax owed by the insured’s heirs.

- Life insurance policy ownership: If the policy is owned by someone other than the insured, such as a spouse or a trust, the death benefit is generally not included in the insured’s estate. This strategy can help reduce the amount of estate tax owed by the insured’s heirs.

- Life insurance policy beneficiary designation: The beneficiary designation on a life insurance policy determines who receives the death benefit. By naming a beneficiary other than the insured’s estate, the proceeds can be excluded from the insured’s estate for estate tax purposes.

“Life insurance can be a valuable tool for estate planning, but it is important to consult with a qualified professional to determine the best strategy for your individual needs.”

Charitable Giving and Estate Planning

Charitable giving can be a powerful tool in estate planning, offering both financial and personal benefits. By strategically incorporating charitable donations into your estate plan, you can reduce your tax liability, support causes you care about, and leave a lasting legacy.

Benefits of Charitable Giving in Estate Planning

Donating to charity can significantly impact your estate planning by providing various tax benefits and fulfilling personal goals.

- Reduced Estate Taxes: Charitable contributions can reduce your taxable estate, lowering the amount of estate taxes your heirs will have to pay. The federal estate tax exemption for 2023 is $12.92 million for individuals and $25.84 million for married couples. This means that if your estate is worth less than this amount, you will not have to pay any estate taxes.

However, if your estate is worth more than the exemption, you will have to pay estate taxes on the excess amount. By donating to charity, you can reduce the size of your taxable estate and potentially lower the amount of estate taxes your heirs will have to pay.

- Income Tax Deductions: Depending on the type of donation, you may be eligible for an income tax deduction in the year you make the gift. This deduction can lower your overall tax liability and provide immediate financial benefits. For example, if you donate $10,000 to a charity, you may be able to deduct that amount from your taxable income, which could save you thousands of dollars in taxes.

- Personal Fulfillment: Giving back to your community can be personally rewarding. You can support causes that are meaningful to you and leave a lasting impact on the world. By incorporating charitable giving into your estate plan, you can ensure that your values and priorities are reflected in your legacy.

Charitable Giving Strategies

There are various ways to incorporate charitable giving into your estate plan, each with its own set of advantages and disadvantages.

- Outright Gifts: You can make a direct donation to a charity during your lifetime. This allows you to receive an immediate tax deduction and provides the charity with immediate access to the funds. Outright gifts can be made in cash, securities, or other assets. This is the simplest and most common method of charitable giving.

- Gifts of Appreciated Property: You can donate appreciated assets, such as stocks or real estate, to a charity. This allows you to avoid paying capital gains tax on the appreciation, which can result in significant tax savings. For example, if you donate stock that has appreciated in value, you will not have to pay capital gains tax on the appreciation when you donate the stock to the charity.

Estate tax planning strategies can be complex, often involving intricate trusts and asset transfers. One crucial aspect of this planning is ensuring that your assets are protected from potential Medicaid spend-down requirements, which can significantly impact your estate’s value. Consulting with a Medicaid planning attorney can help you develop a comprehensive strategy that minimizes your estate tax liability while safeguarding your assets for your loved ones.

This is a popular strategy for those who want to donate appreciated assets without incurring a tax liability.

- Charitable Remainder Trusts: You can create a trust that pays you or a beneficiary a stream of income for a set period, and then distributes the remaining assets to a charity upon your death. This strategy allows you to receive income from your assets during your lifetime while also making a significant donation to charity in the future.

- Charitable Lead Trusts: You can create a trust that pays a fixed amount to a charity for a set period, and then distributes the remaining assets to your beneficiaries. This strategy allows you to make a substantial donation to charity while still providing for your loved ones.

- Donor-Advised Funds: You can establish a donor-advised fund with a public charity, such as a community foundation. You make a contribution to the fund, receive an immediate tax deduction, and then recommend grants to charities over time. This strategy provides flexibility and control over your charitable giving, allowing you to donate to multiple charities over time.

Examples of Charitable Giving in Estate Planning

Here are a few examples of how charitable giving can be incorporated into estate planning:

- A couple with a large estate may establish a charitable remainder trust to provide for their children and grandchildren while also making a significant donation to their favorite charity. The trust could pay a fixed amount to the couple’s beneficiaries for a set period, such as 20 years, and then distribute the remaining assets to the charity upon the death of the last beneficiary. This strategy allows the couple to support their family and their favorite cause while also minimizing their estate tax liability.

- An individual with a large collection of art may donate the collection to a museum in exchange for a charitable deduction. This strategy allows the individual to avoid paying capital gains tax on the appreciation of the art collection while also supporting the museum. The museum can then display the collection for the public to enjoy.

- A family with a successful business may establish a donor-advised fund to support causes they care about. The family can make a contribution to the fund, receive an immediate tax deduction, and then recommend grants to charities over time. This strategy allows the family to support a variety of causes, such as education, healthcare, or the arts.

Estate Planning Documents

Estate planning documents are the legal instruments that Artikel your wishes regarding the distribution of your assets and the management of your affairs after your death. They are crucial for ensuring that your property is distributed according to your wishes and that your loved ones are taken care of.

Will

A will is a legal document that specifies how you want your assets to be distributed after your death. It can be used to name beneficiaries, designate guardians for minor children, and establish trusts.

- A will can be simple or complex, depending on the size and complexity of your estate.

- It is important to review and update your will periodically to reflect any changes in your family, financial situation, or personal wishes.

Trust, Estate tax planning strategies

A trust is a legal arrangement in which one person (the trustee) holds assets for the benefit of another person (the beneficiary).

- There are many different types of trusts, each with its own purpose and benefits.

- For example, a revocable living trust allows you to maintain control over your assets during your lifetime and avoid probate.

- An irrevocable trust can provide tax benefits and asset protection.

Power of Attorney

A power of attorney is a legal document that grants someone else the authority to act on your behalf in financial or legal matters.

- A durable power of attorney remains in effect even if you become incapacitated.

- A power of attorney can be specific to certain tasks or broad in scope.

Healthcare Power of Attorney

A healthcare power of attorney, also known as a medical power of attorney, designates someone to make healthcare decisions for you if you are unable to do so.

- This document is crucial for ensuring that your wishes regarding medical treatment are followed.

- It can be used to appoint a trusted individual to make decisions about your care, such as whether to accept or refuse medical treatment.

Living Will

A living will, also known as an advance directive, Artikels your wishes regarding end-of-life care.

- It can specify whether you want to be kept alive by artificial means, if you want to be resuscitated in the event of a cardiac arrest, and whether you want to be given pain medication.

- It can also specify your wishes regarding organ donation.

Beneficiary Designations

Beneficiary designations are instructions that you provide to financial institutions, such as banks, insurance companies, and retirement plan providers, about who should receive your assets after your death.

- These designations can override the terms of your will.

- It is important to review your beneficiary designations regularly to ensure they are up to date.

Estate Planning Checklist

Here is a checklist of essential estate planning documents:

| Document | Purpose |

| Will | Specifies how your assets will be distributed after your death. |

| Trust | Holds assets for the benefit of another person. |

| Power of Attorney | Grants someone else the authority to act on your behalf. |

| Healthcare Power of Attorney | Designates someone to make healthcare decisions for you. |

| Living Will | Artikels your wishes regarding end-of-life care. |

| Beneficiary Designations | Instructions for financial institutions about who should receive your assets. |

Professional Estate Planning Advice

Navigating the complexities of estate planning can be daunting. While the information presented in this guide provides a solid foundation, seeking professional guidance is crucial to ensure your estate plan effectively addresses your unique circumstances and goals.

The Role of Estate Planning Professionals

Engaging with qualified professionals, such as estate planning attorneys and financial advisors, can help you navigate the intricacies of estate planning and make informed decisions.

- Estate Planning Attorneys: Estate planning attorneys specialize in crafting legal documents that guide the distribution of your assets after your death. They can help you create a comprehensive estate plan that aligns with your wishes and minimizes potential tax liabilities. They also ensure your documents comply with state and federal laws.

- Financial Advisors: Financial advisors provide guidance on managing your assets and investments, ensuring your financial goals are aligned with your estate plan. They can help you understand the tax implications of various investment strategies and ensure your portfolio is structured to support your estate planning objectives.

Finding Qualified Professionals

- Referrals: Seek recommendations from trusted sources, such as family, friends, or other professionals, who have experience with estate planning.

- Professional Organizations: Consult directories of professional organizations like the American Bar Association (ABA) or the National Association of Estate Planners & Councils (NAEPC) to find qualified estate planning attorneys in your area.

- Credentials: Look for professionals with relevant certifications, such as Certified Financial Planner (CFP®) or Certified Estate Planner (CEP®). These credentials demonstrate specialized knowledge and expertise in estate planning.

- Consultations: Schedule initial consultations with several professionals to discuss your needs and evaluate their experience, communication style, and fees. Choose a professional you feel comfortable working with and who understands your goals.

By understanding the nuances of estate tax planning and implementing effective strategies, you can minimize tax liabilities, protect your loved ones, and ensure your hard-earned wealth is distributed according to your wishes. Remember, proactive planning is key to achieving your estate planning goals. Consult with qualified professionals to develop a tailored strategy that aligns with your unique circumstances and aspirations.